ITIN Services

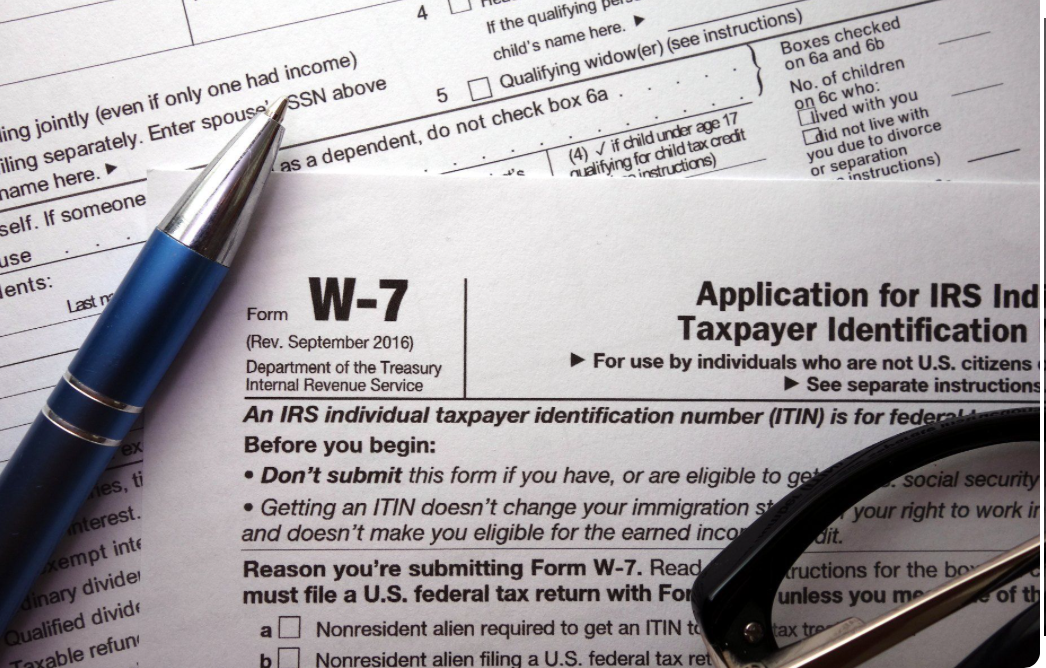

We assist individuals who are not eligible for a Social Security Number in obtaining an Individual Taxpayer Identification Number (ITIN) from the IRS. Our service is ideal for nonresident and resident aliens, their spouses, and dependents who need to file a U.S. tax return or fulfill other tax-related obligations.

Our ITIN services include:

-

Application Preparation (Form W-7) – Completing and reviewing your ITIN application to ensure accuracy and compliance with IRS requirements.

-

Document Verification – Guidance on the required identification documents, including certified copies, passports, and birth certificates.

-

Renewals – Assisting with ITIN renewals to prevent delays in your tax filings.

-

Filing Support – Submitting your ITIN application alongside your federal tax return when necessary.

-

Expert Guidance – Explaining IRS rules regarding ITIN use and avoiding common mistakes that can lead to rejection.

We make the process smooth, secure, and stress-free, so you can meet your tax obligations without complications.